B) False

Correct Answer

verified

Correct Answer

verified

True/False

Yield pricing is a type of "accepting business at a special price" differential analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following reasons would cause a company to reject an offer to accept business at a special price?

A) The additional sale will not conflict with regular sales.

B) The additional sales will increase differential profit.

C) The additional sales will not increase fixed expenses.

D) The additional sales will increase fixed expenses.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Flyer Company sells a product in a competitive marketplace. Market analysis indicates that its product would probably sell at $48 per unit. Flyer management desires a 12.5% profit margin on sales. Flyer's current full cost for the product is $44 per unit. -The desired profit per unit is

A) $6

B) $8

C) $5

D) $4

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Farris Company is considering a cash outlay of $500,000 for the purchase of land, which it could lease for $40,000 per year. If alternative investments are available that yield a 15% return, the opportunity cost of the purchase of the land is

A) $75,000

B) $40,000

C) $44,000

D) $7,500

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Flyer Company sells a product in a competitive marketplace. Market analysis indicates that its product would probably sell at $48 per unit. Flyer management desires a 12.5% profit margin on sales. Flyer's current full cost for the product is $44 per unit. -The target cost of the company's product is

A) $44

B) $42

C) $43

D) $40

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A cost that will not be affected by later decisions is termed a sunk cost.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each phrase that follows with the term (a-e) it describes. Some terms may not be used and other terms may be used more than once. -Fixed costs are included in the markup A)Total cost method B)Variable cost method C)Normal selling price D)Product cost method E)Yield pricing

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nighthawk Inc. is considering disposing of an old machine with a book value of $22,500 and an estimated remaining life of three years. The old machine can be sold for $6,250. A new machine with a purchase price of $68,750 is being considered a replacement. It will have a useful life of three years and no residual value. It is estimated that the annual variable manufacturing costs will be reduced from $43,750 to $20,000 if the new machine is purchased. The three-year differential effect on profit from replacing the machine is a(n)

A) $8,750 increase

B) $31,250 decrease

C) $8,750 decrease

D) $2,925 decrease

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Make-or-buy options often arise when a manufacturer has excess productive capacity in the form of unused equipment, space, and labor.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In deciding whether to accept business at a special price, the short-run price should be set high enough to cover all variable costs and expenses.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Flyer Company sells a product in a competitive marketplace. Market analysis indicates that its product would probably sell at $48 per unit. Flyer management desires a 12.5% profit margin on sales. Flyer's current full cost for the product is $44 per unit. -Using the variable cost method, the markup per unit for 30,000 units (rounded to the nearest dollar) using the following data is Variable cost per unit $15 Total fixed costs $90,000 Desired profit $150,000

A) $10

B) $15

C) $8

D) $23

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following methods used in applying the cost-plus approach to product pricing includes only desired profit in the markup?

A) product cost method

B) variable cost method

C) sunk cost method

D) total cost method

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

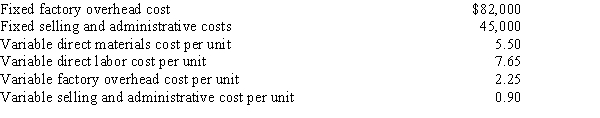

Mallard Corporation uses the product cost method of product pricing. Below is cost information for the production and sale of 45,000 units of its sole product. Mallard desires a profit equal to a 12% return on invested assets of $800,000.

-The markup percentage on product cost for the company's product is

-The markup percentage on product cost for the company's product is

A) 23.4%

B) 10.9%

C) 26.1%

D) 18.0%

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If the total unit cost of manufacturing Product Y is currently $36 and the total unit cost after modifying the style is estimated to be $48, the differential cost for this situation is $48.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A cost that has been incurred in the past, cannot be recouped, and is not relevant to future decisions is termed a

A) period cost

B) differential cost

C) sunk cost

D) replacement cost

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Yasmin Co. can further process Product B to produce Product C. Product B is currently selling for $30 per pound and costs $28 per pound to produce. Product C would sell for $55 per pound and would require an additional cost of $31 per pound to produce. The differential cost of producing Product C is

A) $30 per pound

B) $31 per pound

C) $28 per pound

D) $55 per pound

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In using the product cost method of applying the cost-plus approach to product pricing, selling expenses, administrative expenses, and profit are covered in the markup.

B) False

Correct Answer

verified

Correct Answer

verified

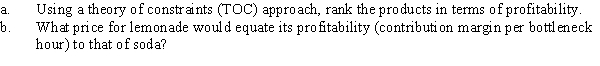

Essay

Sensational Soft Drinks makes three products: iced tea, soda, and lemonade. The following data are available:  Sensational is experiencing a bottleneck in one of its processes that affects each product as follows:

Iced Tea

Soda

Lemonade

Bottleneck process hours per unit

3

3

4

Sensational is experiencing a bottleneck in one of its processes that affects each product as follows:

Iced Tea

Soda

Lemonade

Bottleneck process hours per unit

3

3

4

Correct Answer

verified

Correct Answer

verified

True/False

When estimated costs are used in applying the cost-plus approach to product pricing, the estimates should be based on ideal levels of performance.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 157

Related Exams