A) $1,092

B) $1,150

C) $1,210

D) $1,271

E) $1,334

G) B) and E)

Correct Answer

verified

C

Correct Answer

verified

True/False

If a profitable firm finds that it simply must "stretch" its accounts payable, then this suggests that it is undercapitalized, i.e., that it needs more working capital to support its operations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT directly reflected in the cash budget of a firm that is in the zero tax bracket?

A) Payment lags.

B) Payment for plant construction.

C) Cumulative cash.

D) Repurchases of common stock.

E) Writing off bad debts.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to Exhibit 15.1. What's the difference in the projected ROEs under the restricted and relaxed policies?

A) 1.20%

B) 1.50%

C) 1.80%

D) 2.16%

E) 2.59%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The concept of permanent current assets reflects the fact that some components of current assets do not shrink to zero even when a business is at its seasonal or cyclical low. Thus, permanent current assets represent a minimum level of current assets that must be financed.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

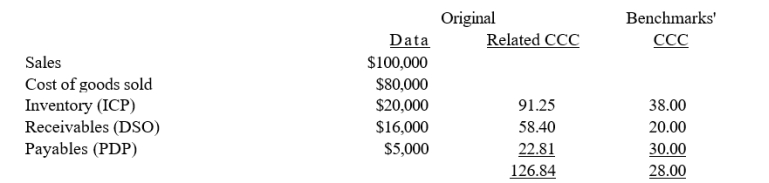

Soenen Inc. had the following data for 2013 (in millions). The new CFO believes that the company could improve its working capital management sufficiently to bring its net working capital and cash conversion cycle up to the benchmark companies' level without affecting either sales or the costs of goods sold. Soenen finances its net working capital with a bank loan at an 8% annual interest rate, and it uses a 365-day year. If these changes had been made, by how much would the firm's pre-tax income have increased?  B) $2,092

C) $2,301

D) $2,531

E) $2,784

B) $2,092

C) $2,301

D) $2,531

E) $2,784

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Atlanta Cement, Inc. buys on terms of 2/15, net 30. It does not take discounts, and it typically pays 60 days after the invoice date. Net purchases amount to $720,000 per year. What is the nominal annual percentage cost of its non-free trade credit, based on a 365-day year?

A) 10.86%

B) 12.07%

C) 13.41%

D) 14.90%

E) 16.55%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the credit terms offered to your firm by its suppliers are 2/10, net 30 days. Your firm is not taking discounts, but is paying after 25 days instead of waiting until Day 30. You point out that the nominal cost of not taking the discount and paying on Day 30 is approximately 37%. But since your firm is neither taking discounts nor paying on the due date, what is the effective annual percentage cost (not the nominal cost) of its costly trade credit, using a 365-day year?

A) 60.3%

B) 63.5%

C) 66.7%

D) 70.0%

E) 73.5%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An informal line of credit and a revolving credit agreement are similar except that the line of credit creates a legal obligation for the bank and thus is a more reliable source of funds for the borrower than the revolving credit agreement.

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

If one of your firm's customers is "stretching" its accounts payable, this may be a nuisance but it does not represent a real financial cost to your firm as long as the customer periodically pays off its entire balance.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A firm's collection policy, i.e., the procedures it follows to collect accounts receivable, plays an important role in keeping its average collection period short, although too strict a collection policy can reduce profits due to lost sales.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Accruals are "spontaneous" funds arising automatically from a firm's operations, but unfortunately, due to law and economic forces, firms have little control over the level of these accounts.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The facts that (1) no explicit interest is paid on accruals and (2) the firm can vary the level of these accounts at will makes them an attractive source of funding to meet the firm's working capital needs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Affleck Inc.'s business is booming, and it needs to raise more capital. The company purchases supplies on terms of 1/10, net 20, and it currently takes the discount. One way of acquiring the needed funds would be to forgo the discount, and the firm's owner believes she could delay payment to 40 days without adverse effects. What would be the effective annual percentage cost of funds raised by this action? (Assume a 365-day year.)

A) 10.59%

B) 11.15%

C) 11.74%

D) 12.36%

E) 13.01%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When deciding whether or not to take a trade discount, the cost of borrowing from a bank or other source should be compared to the cost of trade credit to determine if the cash discount should be taken.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

The target cash balance is typically (and logically) set so that it does not need to be adjusted for either seasonal patterns or unanticipated random fluctuations.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A firm's peak borrowing needs will probably be overstated if it bases its monthly cash budget on the assumption that both cash receipts and cash payments occur uniformly over the month but in reality payments are concentrated at the beginning of each month.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your firm's cost of goods sold (COGS) average $2,000,000 per month, and it keeps inventory equal to 50% of its monthly COGS on hand at all times. Using a 365-day year, what is its inventory conversion period?

A) 11.7 days

B) 13.0 days

C) 14.4 days

D) 15.2 days

E) 16.7 days

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Trade credit is provided only to relatively large, strong firms.

B) Commercial paper is a form of short-term financing that is primarily used by large, strong, financially stable companies.

C) Short-term debt is favored by firms because, while it is generally more expensive than long-term debt, it exposes the borrowing firm to less risk than long-term debt.

D) Commercial paper can be issued by virtually any firm so long as it is willing to pay the going interest rate.

E) Commercial paper is typically offered at a long-term maturity of at least five years.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The maturity matching, or "self-liquidating," approach to financing involves obtaining the funds for permanent current assets with a combination of long-term capital and short-term capital that varies depending on the level of interest rates. When short-term rates are relatively high, short-term assets will be financed with long-term debt to reduce costs.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 122

Related Exams