A) consolidated all of the previous assistance programs into a single program.

B) limited the amount of time that people could receive assistance.

C) said it was no longer necessary for poor people to demonstrate an additional "need," such as small children or a disability, to qualify for assistance.

D) turned all federally-run welfare programs over to the states.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the U.S. government determines that the cost of feeding an urban family of four is $7,500 per year, then the official poverty line for a family of that type is

A) $7,500.

B) $15,000.

C) $22,500.

D) $30,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

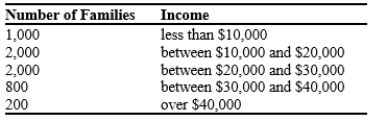

The distribution of income for Dismal is as follows:  If the poverty rate in Dismal is about 17 percent, what is the poverty line in Dismal?

If the poverty rate in Dismal is about 17 percent, what is the poverty line in Dismal?

A) $10,000.

B) $20,000.

C) $30,000.

D) $40,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A disadvantage associated with in-kind transfers to reduce poverty is that they

A) alter peoples' incentives, whereas a negative income tax does not alter peoples' incentives.

B) do not allow poor families to make purchases based on their preferences.

C) can only be distributed by the federal government.

D) cannot restrict the group of recipients and some middle-class families may benefit from them.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-5 Suppose the government implemented a negative income tax and used the following formula to compute a family's tax liability: Taxes owed = (1/4 of income) - $10,000 -Refer to Scenario 20-5. Below what level of income would families start to receive a subsidy from this negative income tax?

A) $10,000

B) $25,000

C) $40,000

D) $50,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

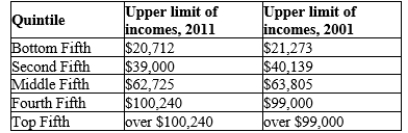

Table 20-7  -Refer to Table 20-7. Which of the following is the best overall conclusion to draw from the data?

-Refer to Table 20-7. Which of the following is the best overall conclusion to draw from the data?

A) The most alarming statistic is the lowering of the top income level that defines the bottom fifth of the income distribution because this indicates that the income distribution is becoming more unequal.

B) The greatest cause for concern is the increase in the minimum income level that defines the top fifth of the income distribution because this indicates that the rich have become richer.

C) The income distribution has been relatively unchanged from 2001 to 2011.

D) Both a and b are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) An advantage of an in-kind transfer is that it prevents an alcoholic from spending a cash benefit on alcohol.

B) An advantage of the Supplemental Security Income (SSI) program is that it benefits the sick and disabled.

C) An advantage of a negative income tax program is that the poor must work to be eligible.

D) Minimum wage laws result in higher unemployment among those groups of workers affected by the minimum wage.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-4 Suppose the government implemented a negative income tax and used the following formula to compute a family's tax liability: Taxes owed = (1/5 of income) - $15,000 -Refer to Scenario 20-4. Below what level of income would families start to receive a subsidy from this negative income tax?

A) $5,000

B) $15,000

C) $50,000

D) $75,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Utilitarians believe

A) that the government should choose just policies as evaluated by an impartial observer behind a "veil of ignorance."

B) in the assumption of diminishing marginal utility.

C) that everyone in society should have equal utility.

D) that the government should not redistribute income.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

Approximately what fraction of total income in the US economy comes from labor earnings?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

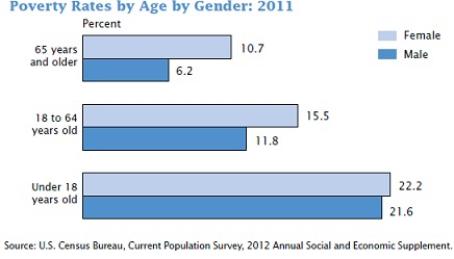

Figure 20-2  -Refer to Figure 20-2. Which of the following is consistent with the data reported in the figure?

-Refer to Figure 20-2. Which of the following is consistent with the data reported in the figure?

A) The female poverty rate is higher for all age groups than the male poverty rate.

B) The disparity between male and female poverty increases with age.

C) Neither a nor b are correct.

D) Both a and b are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The study by economists Cox and Alm found

A) inequality in consumption is much smaller than inequality in annual income.

B) inequality in consumption is slightly smaller than inequality in annual income.

C) inequality in consumption is slightly larger than inequality in annual income.

D) inequality in consumption is much larger than inequality in annual income.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the government provides poor families with antipoverty programs such as welfare, Medicaid, food stamps, and the Earned Income Tax Credit which are all tied to income,

A) the government creates an egalitarian distribution of income.

B) the recipients can usually receive benefits for an unlimited amount of time.

C) it is common for families to face very high effective marginal tax rates.

D) the incentive to work and earn more income remains unchanged.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the value of in-kind transfers are taken into account, the number of families living in poverty in the United States would

A) increase by about 1 percent.

B) decrease by about 1 percent.

C) decrease by about 5 percent.

D) decrease by about 10 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The goal of utilitarians is to

A) punish crimes and enforce voluntary agreements but not to redistribute income.

B) redistribute income until each person has equal earnings.

C) redistribute income until the marginal utility of the wealthiest person equals the total utility of the poorest person.

D) redistribute income based on the assumption of diminishing marginal utility.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Temporary Assistance for Needy Families (TANF) and Supplemental Security Income (SSI) are examples of .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The marketplace allocates resources

A) fairly.

B) efficiently.

C) to those desiring them least.

D) both efficiently and equitably.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The 2011 U.S. distribution of income shows that the top 5 percent of families have approximately what share of income?

A) 4 percent

B) 9 percent

C) 21 percent

D) 49 percent

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following pholitical philosophies would support redistribution of income that makes society fully egalitarian?

A) Liberals, because they believe in the maximin criterion.

B) Libertarians, because they believe in evaluating the process by which economic outcomes arise.

C) Utilitarians, because they believe in diminishing marginal utility.

D) None of the above would support completely egalitarian redistribution of income.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that a family saves and borrows to buffer itself against changes in income. These actions relate to which problem in measuring inequality?

A) in-kind transfers

B) negative income tax

C) transitory versus permanent income

D) economic mobility

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 301 - 320 of 478

Related Exams