A) $31,888

B) $48,112

C) $8,112

D) $40,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A legal document that indicates the name of the issuer, the face value of the bond and such other data is called

A) trading on the equity

B) a convertible bond

C) a bond debenture

D) a bond indenture

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description below to the appropriate term (a-g) . -The principal of the bond issue is paid back in installments

A) EPS

B) Face value

C) Callable bond

D) Indenture

E) Term bond

F) Convertible bond

G) Serial bond

I) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to record the amortization of a premium on bonds payable on an interest payment date would be

A) a debit to Premium on Bonds Payable and a credit to Interest Revenue

B) a debit to Interest Expense and a credit to Premium on Bond Payable

C) a debit to Interest Expense and Premium on Bonds Payable and a credit to Cash

D) a debit to Bonds Payable and a credit to Interest Expense

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

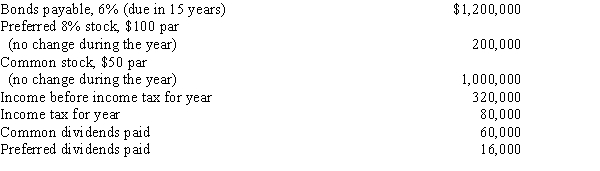

Balance sheet and income statement data indicate the following:  Based on the data presented above, what is the times interest earned ratio (round to two decimal places) ?

Based on the data presented above, what is the times interest earned ratio (round to two decimal places) ?

A) 5.00

B) 5.44

C) 4.00

D) 4.33

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Given the following data, determine the times interest earned ratio.? Net income, $70,000 Bonds payable, issued at face value, 8%, $5,000,000 Preferred stock, $50 par value, 6%, 10,000 shares issued and outstandingTax rate is 30%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation issues for cash $9,000,000 of 8%, 30-year bonds, interest payable semiannually. The amount received for the bonds will be

A) present value of 60 semiannual interest payments of $360,000, plus present value of $9,000,000 to be repaid in 30 years

B) present value of 30 annual interest payments of $720,000

C) present value of 30 annual interest payments of $360,000, plus present value of $9,000,000 to be repaid in 30 years

D) present value of $9,000,000 to be repaid in 30 years, less present value of 60 semiannual interest payments of $360,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds Payable has a balance of $1,000,000 and Premium on Bonds Payable has a balance of $7,000. If the issuing corporation redeems the bonds at 101, what is the amount of gain or loss on redemption?

A) $3,000 loss

B) $3,000 gain

C) $7,000 loss

D) $7,000 gain

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate specified in the bond indenture is called the

A) discount rate

B) contract rate

C) market rate

D) effective rate

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

On August 1, Clayton Co. issued $1,300,000 of 20-year, 9% bonds, dated August 1, for $1,225,000. Interest is payable semiannually on February 1 and August 1. Present the entries to record the following transactions for the current year: (a)Issuance of the bonds. (b)Accrual of interest and amortization of bond discount for the first year, on December 31, using the straight-line method. Round to the nearest dollar when necessary.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Debtors are interested in the times interest earned ratio because they want to

A) know what rate of interest the corporation is paying

B) have adequate protection against a potential drop in earnings jeopardizing their interest payments

C) be sure their debt is backed by collateral

D) know the tax effect of lending to a corporation

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Brubeck Co. issued $10,000,000 of 30-year, 8% bonds on May 1 of the current year, with interest payable on May 1 and November 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions for the current year:May 1Issued the bonds for cash at their face amount.Nov. 1Paid the interest on the bonds.Dec. 31Recorded accrued interest for two months.

Correct Answer

verified

Correct Answer

verified

Essay

On the first day of the fiscal year, a company issues a $500,000, 8%, 10-year bond that pays semiannual interest of $20,000 ($500,000 × 8% × 1/2), receiving cash of $530,000. Journalize the entry to record the issuance of the bonds.

Correct Answer

verified

Correct Answer

verified

True/False

Only callable bonds can be purchased by the issuing corporation before maturity.

B) False

Correct Answer

verified

Correct Answer

verified

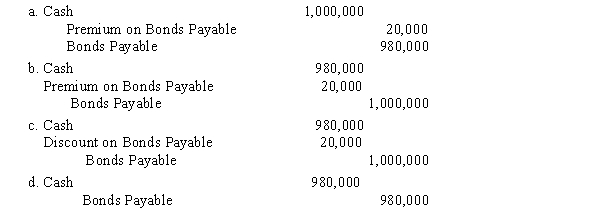

Short Answer

Bonds with a face amount of $1,000,000 are sold at 98. The entry to record the issuance is

Correct Answer

verified

Correct Answer

verified

True/False

If bonds of $1,000,000 with unamortized discount of $10,000 are redeemed at 98, the gain on redemption of bonds is $10,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $300,000 bond was redeemed at 98 when the carrying value of the bond was $292,000. The entry to record the redemption would include a

A) loss on bond redemption of $4,000

B) gain on bond redemption of $4,000

C) gain on bond redemption of $2,000

D) loss on bond redemption of $2,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Levi Company issued $200,000 of 12% bonds on January 1 at face value. The bonds pay interest semiannually on January 1 and July 1. The bonds are dated January 1 and mature in five years on January 1. The total interest expense related to these bonds for the current year ending on December 31 is

A) $2,000

B) $6,000

C) $18,000

D) $24,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

On the first day of the fiscal year, a company issues a $500,000, 8%, 10-year bond that pays semiannual interest of $20,000 ($500,000 × 8% × 1/2), receiving cash of $520,000. Journalize the entry to record the first interest payment and amortization of premium using the straight-line method.

Correct Answer

verified

Correct Answer

verified

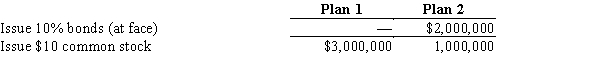

Essay

Jenson Co. is considering the following alternative plans for financing the company:?  Income tax is estimated at 40% of income.Determine the earnings per share of common stock under the two alternative financing plans, assuming income before bond interest and income tax is $1,000,000.?

Income tax is estimated at 40% of income.Determine the earnings per share of common stock under the two alternative financing plans, assuming income before bond interest and income tax is $1,000,000.?

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 181

Related Exams