B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding a 15-year (180-month) $225,000, fixed-rate mortgage is CORRECT? (Ignore taxes and transactions costs.)

A) The outstanding balance declines at a faster rate in the later years of the loan's life.

B) The remaining balance after three years will be $125,000 less one third of the interest paid during the first three years.

C) Because the outstanding balance declines over time, the monthly payments will also decline over time.

D) Interest payments on the mortgage will increase steadily over time, but the total amount of each payment will remain constant.

E) The proportion of the monthly payment that goes towards repayment of principal will be lower 10 years from now than it will be the first year.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Time lines cannot be constructed where some of the payments constitute an annuity but others are unequal and thus are not part of the annuity.

B) A time line is not meaningful unless all cash flows occur annually.

C) Time lines are not useful for visualizing complex problems prior to doing actual calculations.

D) Time lines can be constructed to deal with situations where some of the cash flows occur annually but others occur quarterly.

E) Time lines can only be constructed for annuities where the payments occur at the end of the periods, i.e., for ordinary annuities.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If the discount (or interest) rate is positive, the present value of an expected series of payments will always exceed the future value of the same series.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You would like to travel in South America 5 years from now, and you can save $3,100 per year, beginning one year from today.You plan to deposit the funds in a mutual fund that you think will return 8.5% per year.Under these conditions, how much would you have just after you make the 5th deposit, 5 years from now?

A) $18,369

B) $19,287

C) $20,251

D) $21,264

E) $22,327

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If we are given a periodic interest rate, say a monthly rate, we can find the nominal annual rate by dividing the periodic rate by the number of periods per year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your bank offers a 10-year certificate of deposit (CD) that pays 6.5% interest, compounded annually.If you invest $2,000 in the CD, how much will you have when it matures?

A) $3,754.27

B) $3,941.99

C) $4,139.09

D) $4,346.04

E) $4,563.34

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The present value of a future sum increases as either the discount rate or the number of periods per year increases, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What annual payment must you receive in order to earn a 6.5% rate of return on a perpetuity that has a cost of $1,250?

A) $77.19

B) $81.25

C) $85.31

D) $89.58

E) $94.06

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that you own an annuity that will pay you $15,000 per year for 12 years, with the first payment being made today.You need money today to open a new restaurant, and your uncle offers to give you $120,000 for the annuity.If you sell it, what rate of return would your uncle earn on his investment?

A) 6.85%

B) 7.21%

C) 7.59%

D) 7.99%

E) 8.41%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The going rate of interest on a 5-year treasury bond is 4.25%.You have one that will pay $2,500 five years from now.How much is the bond worth today?

A) $1,928.78

B) $2,030.30

C) $2,131.81

D) $2,238.40

E) $2,350.32

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When a loan is amortized, a relatively high percentage of the payment goes to reduce the outstanding principal in the early years, and the principal repayment's percentage declines in the loan's later years.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Geraldine was injured in a car accident, and the insurance company has offered her the choice of $25,000 per year for 15 years, with the first payment being made today, or a lump sum.If a fair return is 7.5%, how large must the lump sum be to leave her as well off financially as with the annuity?

A) $225,367

B) $237,229

C) $249,090

D) $261,545

E) $274,622

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If CF0 is positive and all the other CFs are negative, then you cannot solve for I.

B) If you have a series of cash flows, each of which is positive, you can solve for I, where the solution value of I causes the PV of the cash flows to equal the cash flow at Time 0.

C) If you have a series of cash flows, and CF0 is negative but each of the following CFs is positive, you can solve for I, but only if the sum of the undiscounted cash flows exceeds the cost.

D) To solve for I, one must identify the value of I that causes the PV of the positive CFs to equal the absolute value of the PV of the negative CFs.This is, essentially, a trial-and-error procedure that is easy with a computer or financial calculator but quite difficult otherwise.

E) If you solve for I and get a negative number, then you must have made a mistake.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

As a result of compounding, the effective annual rate on a bank deposit (or a loan) is always equal to or less than the nominal rate on the deposit (or loan).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An uncle of yours who is about to retire wants to sell some of his stock and buy an annuity that will provide him with income of $50,000 per year for 30 years, beginning a year from today.The going rate on such annuities is 7.25%.How much would it cost him to buy such an annuity today?

A) $574,924

B) $605,183

C) $635,442

D) $667,214

E) $700,575

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A U.S.Treasury bond will pay a lump sum of $1,000 exactly 3 years from today.The nominal interest rate is 6%, semiannual compounding.Which of the following statements is CORRECT?

A) The PV of the $1,000 lump sum has a higher present value than the PV of a 3-year, $333.33 ordinary annuity.

B) The periodic interest rate is greater than 3%.

C) The periodic rate is less than 3%.

D) The present value would be greater if the lump sum were discounted back for more periods.

E) The present value of the $1,000 would be smaller if interest were compounded monthly rather than semiannually.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

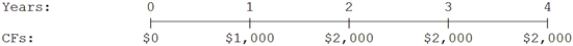

You sold your motorcycle and accepted a note with the following cash flow stream as your payment.What was the effective price you received for the car assuming an interest rate of 6.0%?

A) $5,987

B) $6,286

C) $6,600

D) $6,930

E) $7,277

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have $5,000 invested in a bank that pays 3.8% annually.How long will it take for your funds to triple?

A) 23.99

B) 25.26

C) 26.58

D) 27.98

E) 29.46

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the discount (or interest) rate is positive, the future value of an expected series of payments will always exceed the present value of the same series.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 163

Related Exams