A) Add all changes in interest payable.

B) Add decreases in interest payable and subtract increases in interest payable.

C) Add increases in interest payable and subtract decreases in interest payable.

D) Subtract all changes in interest payable.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would NOT be added to net income in calculating net cash flows from operating activities on a statement of cash flows prepared using the indirect method?

A) Amortization expense.

B) A decrease in accounts receivable.

C) An increase in wages payable.

D) A gain on the sale of equipment.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following represent cash outflows from financing activities?

A) Distributing a stock dividend.

B) Paying a bond's face value at maturity.

C) Issuing long-term bonds at a discount.

D) Paying interest on promissory notes.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The quality of income ratio measures:

A) how much of net income came from operating activities.

B) the proportion of net income that is likely to be collected over time.

C) how much of gross income the company was able to shield from taxes.

D) the portion of net income that is generated by cash from operating activities.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2011, a company paid $4,500 which it owed from its 2010 income tax liability and $30,000 for its 2011 tax liability. The company still owes $6,000 at year-end. How much should the company report as cash paid for income taxes on its 2011 statement of cash flows, using the direct method?

A) $34,500

B) $40,500

C) $30,000

D) $3,500

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the quality of income and fraudulent financial reporting is NOT true?

A) Net income assumes that all revenues are eventually realized as cash inflows and all expenses are realized as cash outflows. The quality of income ratio is a measure of the extent to which this assumption should be considered valid.

B) Fraudulent financial reporting may involve delayed expense recognition.

C) Fraudulent financial reporting is more likely to result in overstatement of net cash flows from operating activities rather than as overstatement of net income.

D) Fraudulent financial reporting may involve aggressive revenue recognition, that is, recognizing revenue before it is earned.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Depreciation expense is not reported on the statement of cash flows when prepared using the direct method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the net cash flows from operating activities?

A) $15,000

B) $5,000

C) ($4,000)

D) ($75,000)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When the cash flows from operating, investing, and financing activities are combined to arrive at the overall net change in cash, a net decrease in cash is subtracted from the beginning cash to calculate the ending cash balance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company reported that its bonds with a face value of $50,000 and a carrying value of $53,000 are retired for $56,000 cash. The amount to be reported under cash flows from financing activities is:

A) ($53,000) .

B) ($3,000) .

C) ($56,000)

D) $0. This is an operating activity.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A negative cash flow is referred to as a cash outflow.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An outdoor water park in the Midwestern states with a calendar year-end is likely to have:

A) unpredictable fluctuations in cash flow from quarter to quarter.

B) the largest cash inflow from operations in the second and third quarters (April - September) .

C) a fairly stable cash flow across all four quarters.

D) the largest cash inflow from operations in the fourth and first quarters (October - March) .

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

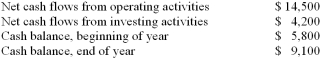

A corporation prepared its statement of cash flows for the year. The following information is taken from that statement:  What is the amount of net cash flows from financing activities?

What is the amount of net cash flows from financing activities?

A) $15,400

B) ($3,300)

C) ($15,400)

D) $3,300

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be classified as an operating activity on the statement of cash flows using the direct method?

A) Cash dividends paid to stockholders.

B) Cash received from selling equipment.

C) Cash paid to retire bonds payable at maturity.

D) Cash received from accounts receivable collections.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company uses the indirect method to determine net cash flows from operating activities:

A) gains must be added to net income and losses subtracted from net income.

B) gains and losses must be added to net income.

C) gains must be subtracted from net income and losses added to net income.

D) gains and losses must be subtracted from net income.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Depreciation is added back to net income in a statement of cash flows prepared using the indirect method because it:

A) reduces income but not cash.

B) is a cash inflow.

C) is a revenue.

D) is a valuation concept.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not needed to prepare a statement of cash flows?

A) Statement of retained earnings.

B) Comparative balance sheet.

C) Additional information on financing and investing activities.

D) Income statement.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be reported as a cash outflow from investing activities?

A) Donating an old piece of equipment to charity.

B) Repaying the principal of a bond.

C) Buying another company's bonds with cash.

D) Paying for an investment asset by issuing company stock.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a company is to succeed over the long-term, a positive cash flow from operating activities is necessary.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true regarding cash flows from financing activities?

A) When companies borrow, cash outflows for financing activities have occurred.

B) When companies receive dividends, cash inflows from financing activities have occurred.

C) When companies repurchase their own stock, cash outflows for financing activities have occurred.

D) When companies pay dividends, cash inflows from financing activities have occurred.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 143

Related Exams