A) the book value of the noncash asset.

B) the market value of the shares.

C) the par value of the shares.

D) the contributed capital of the shares.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In published annual reports

A) subclassifications within the stockholders' equity section are routinely reported in detail.

B) capital surplus is used in place of retained earnings.

C) the individual sources of additional paid-in capital are often combined.

D) retained earnings is often not shown separately.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

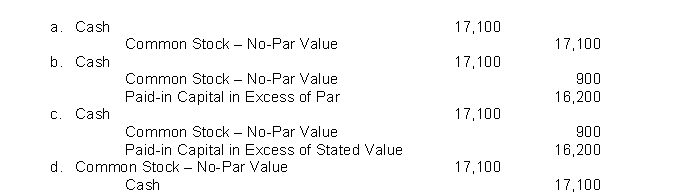

Johnson Company issued 900 shares of no-par common stock for $17,100. Which of the following journal entries would be made if the stock has no stated value?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, Swanson Corporation had 80,000 ordinary shares with a €10 par value outstanding. On March 17, the company declared a 15% share dividend to shareholders of record on March 20. Market value of the shares was €13 on March 17. The entry to record the transaction of March 17 would include a

A) credit to Cash Dividends for ��€36,000.

B) credit to Cash for €156,000.

C) credit to Ordinary Share Dividends Distributable for €120,000.

D) debit to Ordinary Share Dividends Distributable for €120,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

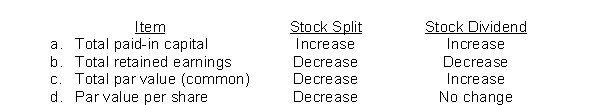

Which of the following show the proper effect of a stock split and a stock dividend?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the stockholders' equity section of the balance sheet

A) Common Stock Dividends Distributable will be classified as part of additional paid-in capital.

B) Common Stock Dividends Distributable will appear in its own subsection of the stockholders' equity.

C) Additional Paid-in Capital appears under the sub-section paid-in capital.

D) Dividends in Arrears will appear as a restriction of retained earnings.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

CAB Inc. has 1,000 shares of 5%, $100 par value, cumulative preferred stock and 50,000 shares of $1 par value common stock outstanding at December 31, 2017. What is the annual dividend on the preferred stock?

A) $50 per share.

B) $5,000 in total.

C) $500 in total.

D) $0.50 per share.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

La Vida Corporation issued 24,000 shares of no-par value ordinary shares for €29.50 per share. Which of the following statements is true?

A) Share Premium-Ordinary account will increase by €276,000.

B) The Cash account will increase by €24,000.

C) Retained Earnings account will increase by €684,000.

D) Share Capital-Ordinary account will increase by €708,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

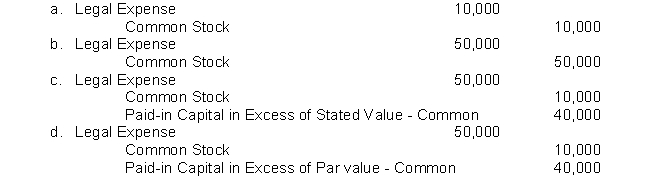

Retro Company is authorized to issue 10,000 shares of 8%, $100 par value preferred stock and 500,000 shares of no-par common stock with a stated value of $1 per share. If Retro issues 10,000 shares of common stock to pay its recent attorney's bill of $50,000 for legal services on a land access dispute, which of the following would be the best journal entry for Retro to record?

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stockholders generally do not have the right to vote for the board of directors.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following statements regarding retained earnings are true except

A) retained earnings represents a claim on cash.

B) a debit balance in Retained Earnings indicates a deficit.

C) some companies may restrict availability of retained earnings for dividends.

D) retained earnings is net income that a company retains in a business.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Logan Corporation issues 40,000 shares of $50 par value preferred stock for cash at $60 per share. In the stockholders' equity section, the effects of the transaction above will be reported

A) entirely within the capital stock section.

B) entirely within the additional paid-in capital section.

C) under both the capital stock and additional paid-in capital sections.

D) entirely under the retained earnings section.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not affect the balance of the Retained Earnings account?

A) Net income.

B) Stock dividend.

C) Stock split.

D) Gains and losses of a company.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a corporation pays taxes on its income, then stockholders will not have to pay taxes on the dividends received from that corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nance Corporation's December 31, 2017 balance sheet showed the following: Nance declared and paid a $85,000 cash dividend on December 15, 2017. If the company's dividends in arrears prior to that date were $24,000, Nance's common stockholders received

A) $61,000.

B) $48,000.

C) $37,000.

D) no dividend.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an investment firm underwrites a stock issue, the

A) risk of being unable to sell the shares stays with the issuing corporation.

B) corporation obtains cash immediately from the investment firm.

C) investment firm has guaranteed profits on the sale of the stock.

D) issuance of stock is likely to be directly to creditors.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The date on which a cash dividend becomes a binding legal obligation is on the

A) declaration date.

B) date of record.

C) payment date.

D) last day of the fiscal year end.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Herman Corporation had net income of $100,000 and paid dividends of $25,000 to common stockholders and $20,000 to preferred stockholders in 2017. Herman Corporation's common stockholders' equity at the beginning and end of 2017s was $450,000 and $550,000, respectively. Herman Corporation's return on common stockholders' equity is

A) 20.0%.

B) 16.0%.

C) 15.0%.

D) 11.0%.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A stock split results in a transfer at market value from retained earnings to paid-in capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about dividends is not accurate?

A) Dividends are generally reported quarterly as a dollar amount per share.

B) Low dividends may mean high stock returns.

C) The board of directors is obligated to declare dividends.

D) Payment of dividends from legal capital is illegal in many states.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 215

Related Exams