A) increase taxes

B) increase the money supply

C) increase government expenditures

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

People choose to hold a smaller quantity of money if

A) the interest rate rises,which causes the opportunity cost of holding money to rise.

B) the interest rate falls,which causes the opportunity cost of holding money to rise.

C) the interest rate rises,which causes the opportunity cost of holding money to fall.

D) the interest rate falls,which causes the opportunity cost of holding money to fall.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The multiplier is computed as MPC / (1 - MPC).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the economic downturn of 2008-2009,the Federal Reserve

A) used open-market operations to purchase mortgages and corporate debt,just as it frequently does even when the economy is functioning normally.

B) took the unusual step of using open-market operations to purchase mortgages and corporate debt.

C) explicitly set its target rate of inflation at zero.

D) explicitly set its target rate of inflation well above zero.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Permanent tax cuts shift the AD curve

A) farther to the right than do temporary tax cuts.

B) not as far to the right as do temporary tax cuts.

C) farther to the left than do temporary tax cuts.

D) not as far to the left as do temporary tax cuts.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the money market is initially in equilibrium.If the price level decreases,then according to liquidity preference theory there is an excess

A) supply of money until the interest rate increases.

B) supply of money until the interest rate decreases.

C) demand for money until the interest rate increases.

D) demand for money until the interest rate decreases.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following raises the interest rate?

A) an increase in government expenditures and an increase in the money supply

B) an increase in government expenditures and a decrease in the money supply

C) a decrease in government expenditures and an increase in the money supply

D) a decrease in government expenditures and a decrease in the money supply

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The Fed can influence the money supply by changing the interest rate it pays banks on the reserves they are holding.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the theory of liquidity preference,an increase in the price level causes the

A) interest rate and investment to rise.

B) interest rate and investment to fall.

C) interest rate to rise and investment to fall.

D) interest rate to fall and investment to rise.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose there is an increase in government spending.To stabilize output,the Federal Reserve would

A) increase government spending.

B) increase the money supply.

C) decrease government spending.

D) decrease the money supply.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"Monetary policy can be described either in terms of the money supply or in terms of the interest rate." This statement amounts to the assertion that

A) shifts of the money-supply curve cannot occur if the Federal Reserve decides to target an interest rate.

B) the aggregate-demand curve will not shift in response to Federal Reserve actions if the Fed decides to target an interest rate.

C) changes in monetary policy aimed at contracting aggregate demand can be described either as decreasing the money supply or as raising the interest rate.

D) the activities of the Federal Reserve's bond traders are irrelevant if the Federal Reserve decides to target an interest rate.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Other things the same,an increase in taxes shifts aggregate demand to the left.In the short run this makes output fall which makes the interest rate rise.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

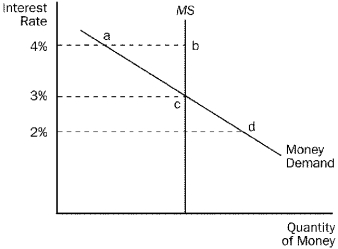

Figure 21-1  -Refer to Figure 21-1.If the current interest rate is 2 percent,

-Refer to Figure 21-1.If the current interest rate is 2 percent,

A) there is an excess supply of money.

B) people will sell more bonds,which drives interest rates up.

C) as the money market moves to equilibrium,people will buy more goods.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in government spending on goods to build or repair infrastructure

A) shifts the aggregate demand curve to the right.

B) has a multiplier effect.

C) shifts the aggregate supply curve to the right,but this effect is likely more important in the long run.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the stock market booms,then

A) aggregate demand increases,which the Fed could offset by increasing the money supply.

B) aggregate supply increases,which the Fed could offset by increasing the money supply.

C) aggregate demand increases,which the Fed could offset by decreasing the money supply.

D) aggregate supply increases,which the Fed could offset by decreasing the money supply.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the multiplier is 5 and that the crowding-out effect is $20 billion.An increase in government purchases of $10 billion will shift the aggregate-demand curve to the

A) right by $150 billion.

B) right by $70 billion.

C) right by $30 billion.

D) None of the above is correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Both the multiplier effect and the investment accelerator tend to make the aggregate-demand curve shift further than it does due to an initial increase in government expenditures.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which particular interest rate(s) do we attempt to explain using the theory of liquidity preference?

A) only the nominal interest rate

B) both the nominal interest rate and the real interest rate

C) only the interest rate on long-term bonds

D) only the interest rate on short-term government bonds

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following events would shift money demand to the left?

A) an increase in the price level

B) a decrease in the price level

C) an increase in the interest rate

D) a decrease in the interest rate

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the investment accelerator from an increase in government purchases is larger than the crowding-out effect,then

A) the multiplier is probably zero.

B) the multiplier is probably equal to one.

C) the multiplier is probably greater than one.

D) the multiplier is probably less than one.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 221 - 240 of 451

Related Exams