A) $0.

B) $3,250,000.

C) $3,900,000.

D) $5,000,000.

E) $6,000,000.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the appropriate description, in determining whether sales/use tax typically must be collected a.Taxable b.Not taxable -Computer equipment purchased by a charity.

A) Taxable

B) Not taxable

D) undefined

Correct Answer

verified

Correct Answer

verified

True/False

S corporations flow-through income amounts to its shareholders, and most states require a withholding of shareholder taxes on the allocated amounts.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Parent and Junior form a unitary group of corporations. Parent is located in a state with an effective tax rate of 3%, while Junior's effective tax rate is 9%. Acting in concert to reduce overall tax liabilities, the group should:

A) Execute an intercompany loan, such that Junior pays deductible interest to Parent.

B) Have Parent charge Junior an annual management fee.

C) Shift Parent's high-cost assembly and distribution operations to Junior.

D) All of the above are effective income-shifting techniques for a unitary group.

E) None of the above is an effective income-shifting technique for a unitary group.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the appropriate description, in determining whether sales/use tax typically must be collected a.Taxable b.Not taxable -A garment purchased for resale.

A) Taxable

B) Not taxable

D) undefined

Correct Answer

verified

Correct Answer

verified

True/False

In most states, legal and accounting services are exempt from the sales/use tax base.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The use tax is designed to complement the sales tax. A use tax typically covers purchases made out of state and brought into the jurisdiction.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the appropriate description, in applying the P.L. 86-272 definition of solicitation -Carrying a free sample of a product to the customer's premises.

A) More than solicitation, creates nexus

B) Solicitation only, no nexus created

D) undefined

Correct Answer

verified

Correct Answer

verified

Multiple Choice

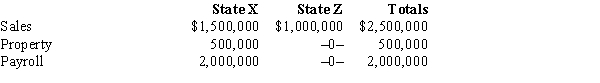

José Corporation realized $900,000 taxable income from the sales of its products in States X and Z. José's activities in both states establish nexus for income tax purposes. José's sales, payroll, and property among the states include the following.

Z utilizes a double-weighted sales factor in its three-factor apportionment formula. How much of José's taxable income is apportioned to Z?

Z utilizes a double-weighted sales factor in its three-factor apportionment formula. How much of José's taxable income is apportioned to Z?

A) $1,000,000

B) $900,000

C) $180,000

D) $0

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Double weighting the sales factor effectively decreases the corporate income tax burden on taxpayers based in the state, such as entities with in-state headquarters.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Typical indicators of income-tax nexus include the presence of customers in the state.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A typical U.S. state piggybacks its collections of the corporate income tax, by letting the Federal government collect and remit the corresponding tax to the state.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Typically exempt from the sales/use tax base is the purchase of tools by a manufacturer to make the widgets that it sells.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the appropriate description, in determining whether sales/use tax typically must be collected a.Taxable b.Not taxable -Computing services purchased by a business.

A) Taxable

B) Not taxable

D) undefined

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Britta Corporation's entire operations are located in State A. Eighty percent ($800,000) of Britta's sales are made in A and the remaining sales ($200,000) are made in State B. B has not adopted a corporate income tax. If A has adopted a throwback rule, the numerator of Britta's A sales factor is:

A) $0.

B) $200,000.

C) $800,000.

D) $1,000,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Flint Corporation is subject to a corporate income tax only in State X. The starting point in computing X taxable income is Federal taxable income. Flint's Federal taxable income is $750,000, which includes a $50,000 deduction for state income taxes. During the year, Flint received $10,000 interest on Federal obligations. X tax law does not allow a deduction for state income tax payments. Flint's taxable income for X purposes is:

A) $810,000.

B) $800,000.

C) $790,000.

D) $750,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following events, considered independently, to its likely effect on WillCo's various apportionment factors. WillCo is based in Q and has customers in Q, R, and S. To this point, WillCo has not established nexus with S. More than one choice may be correct -Q adopts a sales-only apportionment formula.

A) No change in apportionment factors

B) Q apportionment factor increases

C) Q apportionment factor decreases

D) R apportionment factor increases

E) R apportionment factor decreases

F) S apportionment factor increases

G) S apportionment factor decreases

I) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the appropriate description, in determining whether sales/use tax typically must be collected a.Taxable b.Not taxable -Groceries purchased by a consumer and taken home for meal preparation there.

A) Taxable

B) Not taxable

D) undefined

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following items with the appropriate description, in applying the P.L. 86-272 definition of solicitation -Checking the customer's inventory to determine whether a reorder is needed.

A) More than solicitation, creates nexus

B) Solicitation only, no nexus created

D) undefined

Correct Answer

verified

Correct Answer

verified

Multiple Choice

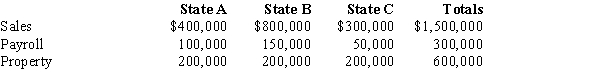

Helene Corporation owns manufacturing facilities in States A, B, and C. A uses a three-factor apportionment formula under which the sales, property and payroll factors are equally weighted. B uses a three-factor apportionment formula under which sales are double-weighted. C employs a single-factor apportionment factor, based solely on sales.

Helene's operations generated $1,000,000 of apportionable income, and its sales and payroll activity and average property owned in each of the three states is as follows.

Helene's apportionable income assigned to A is:

Helene's apportionable income assigned to A is:

A) $0.

B) $266,667.

C) $311,100.

D) $1,000,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 123

Related Exams