B) False

Correct Answer

verified

Correct Answer

verified

True/False

The primary advantage to using accelerated rather than straight-line depreciation is that with accelerated depreciation the present value of the tax savings provided by depreciation will be higher, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm is considering a new project whose risk is greater than the risk of the firm's average project, based on all methods for assessing risk.In evaluating this project, it would be reasonable for management to do which of the following?

A) Increase the estimated NPV of the project to reflect its greater risk.

B) Reject the project, since its acceptance would increase the firm's risk.

C) Ignore the risk differential if the project would amount to only a small fraction of the firm's total assets.

D) Increase the cost of capital used to evaluate the project to reflect its higher-than-average risk.

E) Increase the estimated IRR of the project to reflect its greater risk.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Since the focus of capital budgeting is on cash flows rather than on net income, changes in noncash balance sheet accounts such as inventory are not included in a capital budgeting analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) One advantage of sensitivity analysis relative to scenario analysis is that it explicitly takes into account the probability of specific effects occurring, whereas scenario analysis cannot account for probabilities.

B) Well-diversified stockholders do not need to consider market risk when determining required rates of return.

C) Market risk is important, but it does not have a direct effect on stock prices because it only affects beta.

D) Simulation analysis is a computerized version of scenario analysis where input variables are selected randomly on the basis of their probability distributions.

E) Sensitivity analysis is a good way to measure market risk because it explicitly takes into account diversification effects.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Opportunity costs include those cash inflows that could be generated from assets the firm already owns if those assets are not used for the project being evaluated.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Superior analytical techniques, such as NPV, used in combination with risk-adjusted cost of capital estimates, can overcome the problem of poor cash flow estimation and lead to generally correct accept/reject decisions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

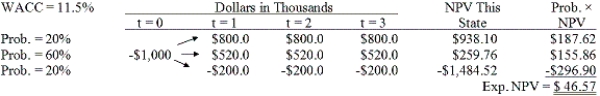

Brandt Enterprises is considering a new project that has a cost of $1,000,000, and the CFO set up the following simple decision tree to show its three most likely scenarios.The firm could arrange with its work force and suppliers to cease operations at the end of Year 1 should it choose to do so, but to obtain this abandonment option, it would have to make a payment to those parties.How much is the option to abandon worth to the firm?

A) $55.08

B) $57.98

C) $61.03

D) $64.08

E) $67.29

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

In cash flow estimation, the existence of externalities should be taken into account if those externalities have any effects on the firm's long-run cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

McLeod Inc.is considering an investment that has an expected return of 15% and a standard deviation of 10%.What is the investment's coefficient of variation?

A) 0.67

B) 0.73

C) 0.81

D) 0.89

E) 0.98

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Erickson Inc.is considering a capital budgeting project that has an expected return of 25% and a standard deviation of 30%.What is the project's coefficient of variation?

A) 1.20

B) 1.26

C) 1.32

D) 1.39

E) 1.46

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The coefficient of variation, calculated as the standard deviation of expected returns divided by the expected return, is a standardized measure of the risk per unit of expected return.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Changes in net working capital should not be reflected in a capital budgeting cash flow analysis because capital budgeting relates to fixed assets, not working capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When evaluating a new project, firms should include in the projected cash flows all of the following EXCEPT:

A) Previous expenditures associated with a market test to determine the feasibility of the project, provided those costs have been expensed for tax purposes.

B) The value of a building owned by the firm that will be used for this project.

C) A decline in the sales of an existing product, provided that decline is directly attributable to this project.

D) The salvage value of assets used for the project that will be recovered at the end of the project's life.

E) Changes in net working capital attributable to the project.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Estimating project cash flows is generally the most important, but also the most difficult, step in the capital budgeting process.Methodology, such as the use of NPV versus IRR, is important, but less so than obtaining a reasonably accurate estimate of projects' cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Under current laws and regulations, corporations must use straight-line depreciation for all assets whose lives are 5 years or longer.

B) Corporations must use the same depreciation method for both stockholder reporting and tax purposes.

C) Using accelerated depreciation rather than straight line normally has the effect of speeding up cash flows and thus increasing a project's forecasted NPV.

D) Using accelerated depreciation rather than straight line normally has no effect on a project's total projected cash flows nor would it affect the timing of those cash flows or the resulting NPV of the project.

E) Since depreciation is a cash expense, the faster an asset is depreciated, the lower the projected NPV from investing in the asset.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 56 of 56

Related Exams