A) a debit to Cash of $525 and a credit to Interest Revenue of $525.

B) a debit to Notes Receivable of $525 and a credit to Cash of $525.

C) a debit to Interest Receivable of $525 and a credit to Interest Revenue of $525.

D) no adjusting entry,since no transaction has occurreD. ![]()

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of December 31,Frappa Company has a balance of $5,000 in accounts receivable.Of this amount,$500 is past due and the remainder is not yet due.Frappa has a credit balance of $45 in the allowance for doubtful accounts.Frappa Company estimates its bad debt losses using the aging of receivables method,with estimated bad debt loss rates equal to 1% of accounts not yet due and 10% of past due accounts.How would the required adjusting journal entry be recorded in the Allowance for Doubtful Accounts?

A) $95 (credit) .

B) $55 (credit) .

C) $50 (credit) .

D) $45 (debit) .

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

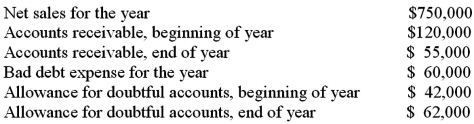

The following information is available for a company at the end of the year:  What was the amount of write-offs during the year?

What was the amount of write-offs during the year?

A) $62,000

B) $0

C) $55,000

D) $40,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company that uses the allowance method writes off an actual bad debt:

A) total assets decrease.

B) total liabilities increase.

C) total expenses increase and total revenues increase.

D) total assets,revenues,and expenses remain the same.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

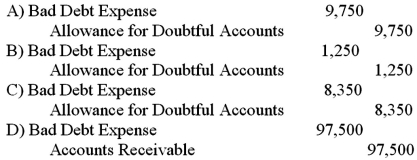

Use the information above to answer the following question.Assuming the company estimates bad debts as 1.3% of credit sales,what is the required adjusting entry to record bad debt expense for the year?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Credit card companies charge a fee to the seller that accepts the credit cards.This fee is recorded by the seller as a non-operating expense on its income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the year,a company that uses the allowance method concludes that $6,844 of specific customer accounts will not be collected.These are written off by:

A) debiting Accounts Receivable and crediting Allowance for Doubtful Accounts for $6,844.

B) debiting Accounts Receivable and crediting Bad Debt Expense for $6,844.

C) debiting Bad Debt Expense and crediting Accounts Receivable for $6,844.

D) debiting Allowance for Doubtful Accounts and crediting Accounts Receivable for $6,844.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company has previously averaged about 26% of its accounts receivable in the "over 90 days past due" category but now forecasts 18% in this category.You use the aging of accounts receivable method of estimating bad debt expense.If the total of credit sales remains unchanged from previous months and no write offs are made,the estimate of bad expense based on the new forecast will:

A) increase over the estimate for previous months.

B) decrease over the estimate for previous months.

C) not change.

D) will depend on the percentage of credit sales deemed uncollectible.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the direct write-off method,the estimated amount of bad debts is debited to which account?

A) Bad Debt Expense.

B) Allowance for Doubtful Accounts.

C) Accounts Receivable.

D) Bad debts are not estimated under the direct write-off method.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of the third year,the Treadwell Tire Company had accounts receivable of $66,600,and at the end of the fourth year,the company had accounts receivable of $72,600.If the company's net sales revenue during the fourth year were $876,000,the days to collect during year four was (Round all calculations to one decimal place. ) :

A) 12.6

B) 29.0

C) 8.0

D) 34.0

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2014,Lawrence Company had gross sales of $750,000 on account and granted sales discounts of $15,000.On January 1,2014,the Allowance for Doubtful Accounts had a credit balance of $18,000.During 2014,$30,000 of uncollectible accounts receivable were written off.Past experiences indicate that 3% of net credit sales become uncollectible.Using the percentage of credit sales method,what would be the adjusted balance in the Allowance for Doubtful Accounts at December 31,2014?

A) $10,050.

B) $10,500.

C) $22,050.

D) $34,500.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

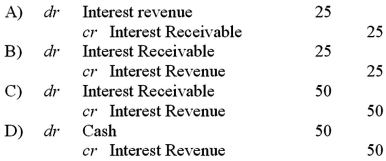

Preston Corporation issues a $3,000 note to Fulton Corporation on March 1,which carries interest at an annual rate of 5%.Interest is payable when the note matures on June 30.What entry will Fulton make at its year-end,April 30,if interest on the note has not previously been accrued?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On July 1,2014,Icespresso Inc.signed a two-year $8,000 note receivable with 9 percent interest.At its due date,July 1,2016,the principal and interest will be received in full.Interest revenue should be reported on Icepresso's income statement for the year ended December 31,2014,in the amount of:

A) $1,440.

B) $720.

C) $420.

D) $360.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The direct write-off method for uncollectible accounts is not allowed by either GAAP or IFRS,but is required by the IRS.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The direct write-off method for uncollectible accounts:

A) ignores the matching principle.

B) is an acceptable alternative method of recognizing bad debt expense under GAAP.

C) results in higher bad debt expense for most companies.

D) may only be used by companies that do not extend credit to their customers.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company lends cash to a customer who signs a promissory note:

A) net assets decrease for the current accounting period,but increase when the money is repaid.

B) net assets increase in the current accounting period but revenues increase when the money is repaid.

C) net assets increase and liabilities increase when the transaction occurs.

D) net assets and net income do not change when the transaction occurs.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the interpretation of the receivables turnover ratio is not true?

A) Analysts often interpret a sudden increase in the receivables turnover ratio as a signal of a developing problem.

B) The smaller the receivables turnover ratio the larger the days to collect will be.

C) A change in the receivables turnover ratio may indicate a change in the company's credit granting policies.

D) A change in the receivables turnover ratio may indicate a change in economic conditions.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When interest is calculated for periods shorter than a year,the formula to calculate interest is:

A) I = P x R x T,where I = interest calculated,P = principal,R = annual interest rate,and T = number of months.

B) I = P x R x T,where I = interest calculated,P = principal,R = annual interest rate,and T = (number of months ÷ 12)

C) I = P x R x T,where I = interest calculated,P = principal,R = monthly interest rate,and T = (number of months ÷ 12) .

D) I = (MV - P) /T,where I = interest calculated,MV = maturity value,P = principal and T = number of months.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Momentum Products Inc. ,just recorded an adjusting journal entry for the current year's estimate of bad debts.Assuming all else is equal,this adjusting journal entry will cause:

A) the accounts receivable turnover ratio to increase.

B) net income to increase.

C) total assets to remain unchanged.

D) net accounts receivable to increase.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company lent a customer $5,000 to satisfy the customer's overdue accounts receivable.The loan is for one year at an annual interest rate of 5%.Six months later the customer repays the principal and interest.The principal part of the repayment should be recorded as a:

A) debit to Cash and credit to Notes Receivable.

B) debit to Notes Receivable and credit to Accounts Receivable.

C) debit to Cash and credit to Accounts Receivable.

D) debit to Notes Receivable and credit to Cash.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 146

Related Exams